MARKET RANGE

Be it Forex, indices, commodities, or something more exotic, our wide range of products covers the world’s largest and most liquid markets. Discover our full range of different markets.

Forex

Regardless of whether it is Forex, indices, Commodities, or something more exotic, our wide range of products covers the world’s largest and most liquid markets. Learn more about our full range of various markets.

- 45 currency pairs

- Tight ECN spreads from 0.0 pips

- 1:100 leverage

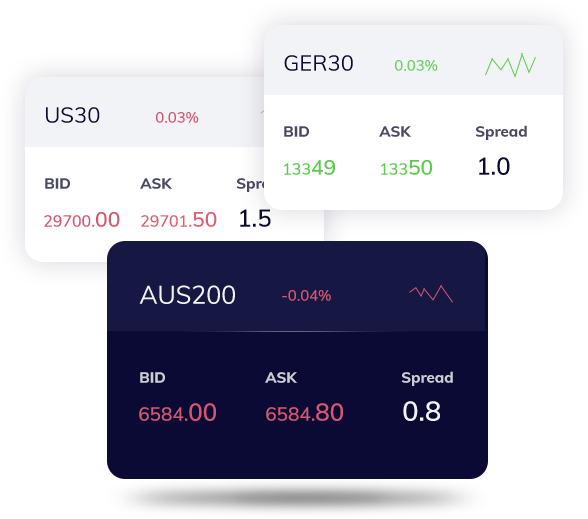

Indices

If you’re after tight spreads and great execution then you’ll love our Index CFD offering. We use specialist non-bank market makers to derive a fast and sharp price across our range of Index CFDs.

You’ll frequently see one of the tightest spreads in the world on the Dax and Dow, two of the most popular indices for CFD traders.

- 10 Indices to trade from across the globe

- 1% margins

- No commissions

Commodities

Commodities markets such as Gold and Oil are popular with traders due to their trending nature and sometimes rapid moves. This potential for high volatility and large price moves combined with 24/5 trading, and generous trading conditions have made the commodities market a place of risk and reward for the advanced trader.

Tier-1 banks and ECNs keep our metals spreads super tight, while we use the world’s fastest non-bank market makers who specialize in oil trading to give you the tightest prices and best execution on our spot oil products.

- 20 commodities

- Metals, energies, softs

- 1% margins

ECN Account Features

-

Pricing & Execution

ECN | STP | NDD

-

Minimum Deposit

A €200 or equivalent

-

Min. Trade Size

0.01 Lots

-

Spreads

From 0.0 Pips

-

Zero Fee

Funding & Withdrawal

-

Max. Trade Size

Up to 1000 Lots

-

Leverage

1:100 or 1:200

-

Margin Call/Stop

120% & 100%

-

Free VPS

Trade over 20 lots / month

-

Available Markets

48 FX, 20 Commodities, 14 Indices

-

ECN Account Types

Individual, Joint, Corporate and Trust accounts

-

Currencies & Commissions

7 AUD, 7 USD, 6.2 EUR, 5.4 GBP, 9.5 SGD, 9 CAD

* 2,000 EUR commissions per month requirement – commission may be negotiated but minimum comms stays the same – volume requirement increases as commissions goes down. Tiering is also possible.

Frequently Asked Questions

Electronic Communications Networks or ‘ECNs’ are off-exchange execution venues which allow market participants to trade with a range of counter-parties anonymously. They are the main trading venues for OTC markets such as Foreign Exchange and Metals.

This basically means ECNs provide the technology and venue for price makers aka ‘liquidity providers’ to distribute their liquidity. Price takers (traders) can see these prices and execute trades against them. The ECN is therefore responsible for prices/quotes and the execution of orders.

Markets Invest offers over 80 markets for clients to access across Forex, Metals, Energies, Hard and Soft Commodities, and Equity Indices.

As a broker that runs a low risk business model, we offer a standard leverage of 1:100 and a maximum of 1:200 that can be approved pending an assessment of the riskiness of your trading style.

An ECN broker provides a market for its clients to trade. This means it streams quotes from participants of the ECN and matches orders against these. It is therefore like a virtual exchange where trades and risk are transferred among participants of the ECN rather than being internalized by the broker.

When you execute an order on one of our CFD products, you are buying an OTC derivative that references the underlying futures market as one of the factors that determines its price. These CFD products are non-deliverable, cash settled derivatives that offer clients the ability to speculate on price movements and hedge exposure.

The futures market is an exchange where traders can purchase deliverable futures by purchasing contracts with a defined expiry date. Deutschtrader does not provide access to the futures market. These products are not to be confused with the CFDs that Markets Invest offers.

Refer to our Indices and Commodities pages for more information on each product type.

Market hours differ per product. Forex is generally 24/5, from Sunday 17:00 EDT/ET to Friday 17:00 EDT/ET. Indices and Commodities market hours follow the local timezone of the market which the product is based.

No, commissions are not charged on CFD trading.